Property Tax Rate Oconee County Sc . The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Oconee county is rank 42nd. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00.

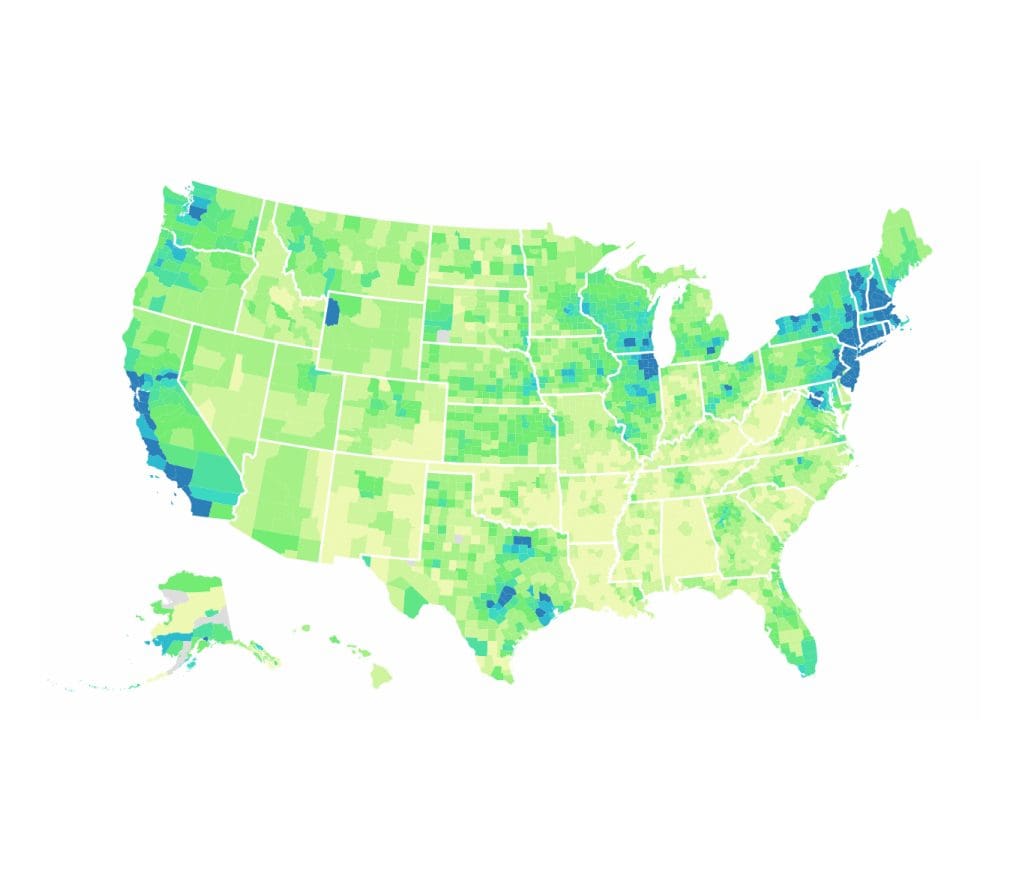

from taxfoundation.org

The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county is rank 42nd. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,.

County Property Taxes Archives Tax Foundation

Property Tax Rate Oconee County Sc Oconee county is rank 42nd. The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county is rank 42nd.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate Oconee County Sc Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,. The table below shows the median home value, median annual property tax payment and average effective property tax rate for. Property Tax Rate Oconee County Sc.

From www.mapsales.com

Oconee County, SC Wall Map Color Cast Style by MarketMAPS Property Tax Rate Oconee County Sc The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county is rank 42nd. Our oconee county property tax calculator. Property Tax Rate Oconee County Sc.

From mungfali.com

Oconee State Park Map Property Tax Rate Oconee County Sc Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Oconee county is rank 42nd. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for. Property Tax Rate Oconee County Sc.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate Oconee County Sc Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on. Property Tax Rate Oconee County Sc.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate Oconee County Sc Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you. Property Tax Rate Oconee County Sc.

From www.oconeecountyobservations.org

Oconee County Observations Oconee School Board Announces Public Property Tax Rate Oconee County Sc Oconee county is rank 42nd. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The table below shows the median home value,. Property Tax Rate Oconee County Sc.

From www.landsofamerica.com

3 acres in Oconee County, South Carolina Property Tax Rate Oconee County Sc The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our oconee county property tax. Property Tax Rate Oconee County Sc.

From redpawtechnologies.com

OCONEE COUNTY, SC Red Paw Technologies Property Tax Rate Oconee County Sc The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Oconee county is rank. Property Tax Rate Oconee County Sc.

From patch.com

Oconee County Special Purpose Local Option Sales Tax Growth Rate For Property Tax Rate Oconee County Sc Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real estate, personal vehicle, business vehicle,. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also known as real estate tax) in oconee county is $600.00. Property Tax Rate Oconee County Sc.

From jvccc.org

Property Tax Rate Comparison Jersey Village Neighbors Property Tax Rate Oconee County Sc The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for your real. Property Tax Rate Oconee County Sc.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate Oconee County Sc Oconee county is rank 42nd. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our tax estimate calculator will estimate the amount of taxes due in oconee. Property Tax Rate Oconee County Sc.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rate Oconee County Sc Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Oconee county is rank 42nd. The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina. Property Tax Rate Oconee County Sc.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate Oconee County Sc The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value of $126,700.00. Oconee county is rank 42nd. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our oconee county property tax calculator can estimate your property taxes based on. Property Tax Rate Oconee County Sc.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Property Tax Rate Oconee County Sc Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina. Property Tax Rate Oconee County Sc.

From www.oconeecountyobservations.org

Oconee County Observations Oconee County School System Releases Property Tax Rate Oconee County Sc The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The median property tax (also known as real estate tax) in oconee county is $600.00 per year, based on a median home value. Property Tax Rate Oconee County Sc.

From www.spartanburgcounty.org

2017 Capital Penny Sales Tax Referendum Spartanburg County, SC Property Tax Rate Oconee County Sc Oconee county is rank 42nd. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Our tax estimate calculator will estimate the amount of taxes due in oconee county, sc for. Property Tax Rate Oconee County Sc.

From gadgets2018blog.blogspot.com

Oconee County Tax Map Gadgets 2018 Property Tax Rate Oconee County Sc The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. The table below shows the median home value, median annual property tax payment and average effective property tax rate for every south carolina county. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. Property Tax Rate Oconee County Sc.

From www.land.com

24.06 acres in Oconee County, Property Tax Rate Oconee County Sc The treasurer's office collects current real property taxes, personal property taxes, and motor vehicle taxes. Our oconee county property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Oconee county is rank 42nd. Oconee county (0.42%) has a 20.8% lower property tax rate than the average of south carolina (0.53%). The. Property Tax Rate Oconee County Sc.